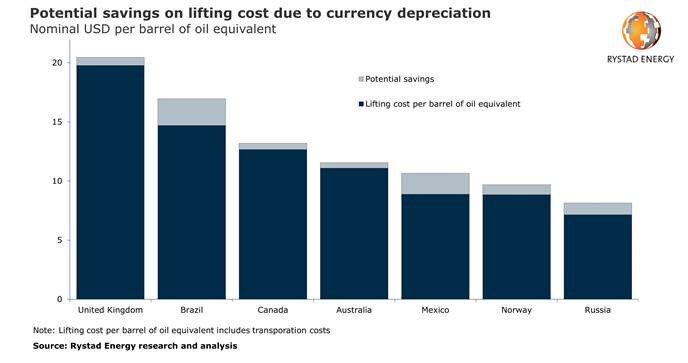

Lifting costs per barrel of oil equivalent (BOE) could drop significantly as a byproduct of the COVID-19 pandemic and price collapse, with Brazil leading the world in savings, according to a recent analysis by Rystad Energy. Rystad calculates Brazil’s savings at $2.30/bbl compared to its pre-downturn estimate. Mexico’s savings rank second, at $1.80/bbl, and Russia’s third, at $1/bbl. The top three savers are followed by Norway, the UK, Canada, and Australia.

The savings result at least in part from the depreciation of global currencies against the US dollar, as most operating expenses (OPEX) in oil and gas production are realized in local currencies. “Currency depreciation could have a mixed effect on oil and gas projects. On the one hand, fields under development may face higher costs, as most of the contracts involved are awarded in US dollars. On the other hand, already-producing fields stand to benefit from depreciating exchange rates, as operating costs are mainly paid in local currencies,” Sara Sottilotta, Rystad Energy’s oilfield services analyst, said.

Lifting costs are calculated as OPEX divided by BOE produced. Adjusting for the share of OPEX purchases made in domestic currencies against the exchange devaluation within the most-impacted countries, Rystad expects potential savings of up to 17% on lifting cost per BOE. Brazil, Mexico, and Russia are poised to benefit most from their local currencies’ depreciation, with OPEX per BOE potentially falling by between 13% and 17%. Lifting cost reductions in the UK, Canada, Australia, and Norway could generate potential savings of between 3% and 9%.

In actual lifting costs, Russia leads savers, at $7.20/bbl. Brazil’s per-barrel lifting cost is now estimated at approximately $14.70. In total, Russia leads in terms of savings for the remainder of 2020. The country’s substantial production will help it realize $8.70 billion in reduced OPEX. Brazil follows with $2.6 billion, Mexico and Canada with $1.6 billion each, Norway with $1.2 billion, and the UK and Australia with $0.5 billion each.

Despite the fact that operators are leaving no stone unturned in their search for further cost savings, Rystad believes that the current downturn is unlikely to generate the same level of efficiency and productivity improvements as in 2014 to 2016; much of the potential has already been exhausted.

“Under these circumstances, currency gains could emerge as a free boost, helping operators to maintain profitable operations at producing fields even amidst the brutal prevailing oil market conditions,” Sottilotta said.

Production Lifting Costs Shrinking

Compartir nota:

Twitter

LinkedIn

WhatsApp

Facebook