Summary

- The energy transition is underway, but the movement is fragmented and slow. Even in the US, the transition is likely to take between 30 and 70 years, perhaps longer.

- Maersk’s net-zero promise sounds great on the surface, but things are far more complex. Changes must be made across the value chain to reduce emissions and keep cleaner fuel affordable.

- While the move to cleaner fuels reduces the need for oil, economics support the continued use of natural gas and even other dirtier products such as petroleum coke.

- Hydrogen projects derived from renewables are appearing, but this production is expensive which may limit its growth.

- Energy companies and sovereignties like Saudi Arabia are far from dead. They can use free cash flow to divest into other sectors of energy such as renewables, hydrogen, ammonia, and methanol.

Recap

Ultimately, we want to answer the question, «Is oil and gas an investable sector or is it in terminal decline? If it is in terminal decline, how long will that take and what options do they have?» First, let’s take stock of the overall discussion. In Enlink’s Earnings Drought is Over, we dug into the topic of terminal decline and how this effects valuation. In Small And Mid-Cap Midstream Review and Targa Resources: Rewarding Shareholders, we showed how midstream energy companies are increasingly self-funding their operations and paying down debt, as the amount of capital pouring into energy companies dried up and the great American shale buildout reached a plateau. If you follow energy markets, you know that investors, including large institutional investors and financiers, are increasingly shifting their dollars to ESG friendly investments (which is stretching valuations), and they are shunning the oil and gas sector.

In Oil and Gas Companies Battle The Net-Zero Tsunami, we started the discussion by listing seven recent impacts of the energy transition that are disrupting the business as usual energy market, and then we dove into a discussion of the timeline for the Net-Zero transition, showing that the level of US investment in renewables like wind and solar needs to double to help the US reach their net-zero 2050 goals. Ultimately, the data shows that the US energy transition is probably a 30-70 year endeavor to transition our grid to renewable energy and convert all our gasoline powered cars and light duty trucks to an EV fleet. In this scenario, we left other areas unconverted such as natural gas heating and jet, shipping and diesel fuel. In doing this calculation, we tabled many of the caveats that can also impact the change and therefore, the transition is likely to be considerably more complex and take longer to achieve.

The data showed that unless drastic changes are made (including a massive increase in investment), it is likely we will get a mixed transition as described by Lyn Alden Schwartzer in her thoughtfully researched Seeking Alpha article, «The Case for a Longer-Term Oil and Gas Bull Market.» Although the extent of the transition and the pathways it takes is certainly up for debate, this fragmented transition is apparent on all scales whether you look at a leading case like California which still generates nearly half of its electricity from natural gas or globally with Europe having taken a leadership role but other countries like India and China continuing to lag in terms of emissions reductions.

Another key takeaway from that discussion (including the heated debate in the comments section) is that nobody, including the EIA and other modelers of future energy consumption can fully predict the outcome. For example, the rate of EV adoption is unknowable, and modelers have resorted to wide ranges to account for that uncertainty. The transition could accelerate or conversely stall, but what is increasingly clear is that a transition is underway, and its impact on the energy market will be substantial. Energy investors should understand the key factors driving the energy transition including policy changes. They should understand how quickly it is progressing and the factors like increased wind and solar investment and EV adoption that could propel it forward or conversely, hold it back. They should also look for energy companies who are ahead of the curve in adopting future-proofed energy investments and have low debt profiles.

Shipping, the case of Maersk

Given that backdrop, we are now going to discuss how net-zero demand changes are beginning to reshape energy markets by looking at one more example, Maersk (AMKBY), a company based out of Denmark. This example helps round out the discussion because it tackles another factor in the energy debate, shipping fuel. According to the American Bureau of Shipping, «the shipping industry is critical to the global economy, with over 11 million metric tons of goods shipped in 2019, representing an $18.9 trillion trade value. Marine vessels carry around 80 percent of world trade volume and 70 percent of its value, while accounting for 2.9 percent of worldwide carbon dioxide (CO2) emissions.» Although the amount of CO2 emissions is relatively small, understanding the pathways to net-zero are instructive because many of the hurdles faced by the industry mirror the challenges in other sectors, for example jet fuel.

If you follow the energy transition debate, ships are some of the hardest to decarbonize, because outfitting these vessels with batteries simply kills the economics of transport and recharging a ship at sea or portside is untenable, but there are alternatives to batteries that get the job done. In December 2018, Maersk, the world’s largest container shipping company, pledged to reduce all carbon emissions by 2050. They will increasingly convert their ships to run on methanol, bio-methanol and ammonia over the course of 20 years. Maersk recently announced that its first carbon-neutral container vessel will be on the water by 2023 (assuming they can profitably source the carbon free fuel), seven years ahead of schedule.

When you step back and look at Maersk’s overall net-zero 2050 promise, it sounds like progress and it is, but the production of methanol or ammonia still produces a tremendous amount of CO2 if these products are produced through conventional means. For example, when you consider the entire lifecycle of producing methanol, the direct benefit from using methanol over very low sulfur shipping fuel is a 6% reduction in carbon emissions according to ABS. However, what Maersk’s signaling does is set the stage for all companies and regulating organizations to walk through the energy transition together over several decades, and it helps prepare Maersk for this eventuality.

Since Maersk will essentially outsource their emissions, producers of methanol and ammonia will increasingly need to find ways to reduce their scope 1 and scope 2 emissions through carbon capture (or other means) to address the entire energy value chain. Let’s dive into a discussion about these energy pathways and the likely direction they will travel.

Ammonia

Here’s ABS again on the benefits of Ammonia:

«Ammonia is one of the two zero-carbon fuels considered for use in the marine sector and its production pathway is directly related to hydrogen. Therefore, the challenges associated with green hydrogen production and scale up also apply to ammonia production. The key benefits of ammonia stem from its higher density than hydrogen and the fact that it can stored as a liquid at -33° C and ambient pressure on board the vessel and at port site facilities. These factors make ammonia a more volumetrically effective energy carrier than hydrogen, and offer easier distribution, storage and bunkering.»

When ABS talks about ammonia as a zero-carbon fuel, it’s important to note that burning the fuel produces no admissions, but the production of ammonia, produces a tremendous amount. Ammonia is typically made from natural gas, LPG (liquid petroleum gas) or naphthalene. Naphtha is primarily derived from oil and gas condensate. LPG is a composite of natural gas liquids, primarily propane and butane, two products derived from fractionation plants run by the likes of midstream companies such as Enterprise Products Partners (EPD), Targa Resources (TRGP) and EnLink Midstream (ENLC).

Typically called gray ammonia, this conventional production has a 100-year history, reacting produced hydrogen and nitrogen pulled from the air. This pathway uses a chemically famous process called the Haber-Bosch process to create 180 million metric tons of ammonia annually of which 80% is used as fertilizer for agricultural purposes. The hydrogen in the US typically comes from steam methane reforming using natural gas. To reduce or eliminate the carbon footprint, ammonia can also be derived through two other processes as shown in figure 1 – so called blue and green ammonia – but these add costs to the process.

Figure 1: Source, The Green Ammonia Consortium

Methanol

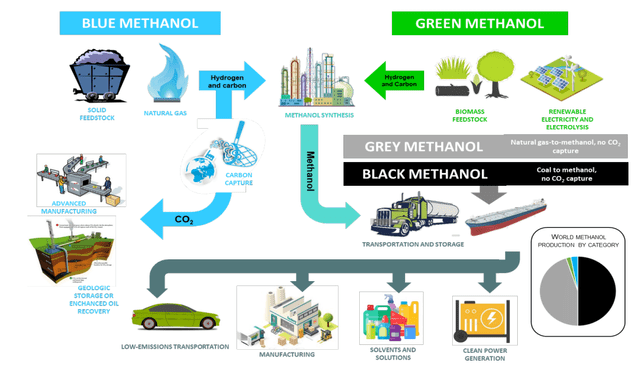

Liquid methanol is also an excellent choice for conversion from conventional fuels because at ambient temperature and pressure methanol can be employed in older ships with minor tank retrofitting which will allow ships to hold the larger volumes of methanol required for an equivalent amount of energy. Methanol is primarily made by synthesizing it from natural gas or coal (see figure 2) because this is the least expensive method.

Figure 2, source

China relies on coal to produce methanol due to the abundance of coal in that region of the world. The US relies on natural gas. Methanex (MEOH), the world’s largest supplier of methanol, moved plants from Chile to Louisiana so they were close to natural gas shale feedstocks. Methanol produced from natural gas and coal is so-called grey and black methanol (respectively), but it can be converted to blue methanol if the emissions from that process are captured and stored. The cost of producing fossil fuel-based methanol is in the range of $100-$250/mt (metric tons), with carbon capture sequestration ((CCS)) costing a bit more.

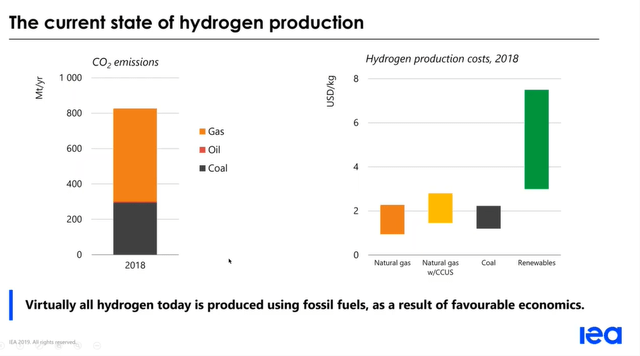

The cost of producing e-methanol, green methanol, is $800-$1600/mt (metric ton). Due to the high costs, currently there is only one e-methanol plant in the world located in Iceland. E-methanol is expensive because the input of hydrogen using electrolysis is more expensive than other pathways (see figure 3).

Figure 3, source: IEA

Hydrogen

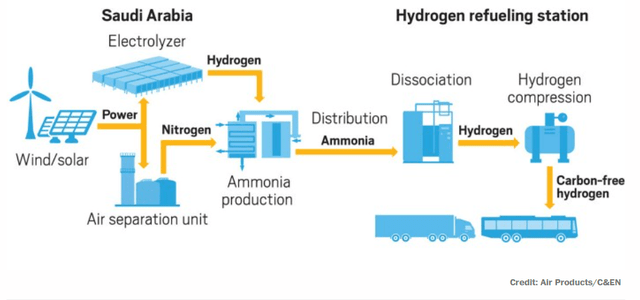

With costs for wind and solar falling, there are regions in the world where hydrogen could become economically viable especially if regions develop surplus energy during peak hours and peak seasons or in regions blessed with either wind or solar energy. Hydrogen could be exported to other regions with higher operational costs using trucks, ships or pipeline, however transporting hydrogen is expensive. Pipelines need to be specially outfitted to handle the pressure and reduce the tendency for pipelines to become brittle and crack.

For that reason, hydrogen in many cases will be produced locally at points of delivery or potentially converted to ammonia which is easier and safer to transport than hydrogen (see figure 4) and then either burned as ammonia or converted back into hydrogen. For example, Saudi Arabia has announced a $5 billion project in conjunction with US based Air Products and Chemicals (APD) to produce ammonia. The ammonia will be shipped to demand centers and converted back to hydrogen to be used in fuel cells to power buses and cars. This is a prime example of a leading oil and gas producer (Saudi Arabia) using its considerable cash flow and resources to diversify its energy portfolio, although the returns on that project may be less than their oil and gas portfolio.

Figure 4, source: Air Products/C&EN

Bio-methanol

On the surface, bio-methanol appears to be an option with current costs around $320/mt to $720/mt, but not fully scalable as the amount of acreage needed to produce the biomass would compete with other biofuels, namely biodiesel and corn-based ethanol, and using deforestation to create more acreage defeats the purpose. Although some biomass waste has a small but niche role to play, using biomass for fuel en masse – essentially scraping our planet of living and dead plants, crops and trees or using farmland to produce it on a large scale – seems to be a poor substitute for real progress.

There is mounting evidence that biofuels, due to the inefficiencies of producing it, causes more greenhouse gases than fossil fuels when you consider the entire lifecycle of the biofuel systems and the fact that biomass and biofuels have a very low energy density. There is also one byproduct not shown in any of the charts for the «green» methanol side of the chart – inflation – lots and lots of inflation. Already, costs for feedstocks for biodiesel and other biofuels have doubled in 12 months.

Carbon Capture and Sequestration ((CCS))

To sell methanol or ammonia as a blue carbon fuel using hydrocarbons, we need to capture the emissions from that process and either bury them underground or reuse the CO2 to make other products or use it for enhanced oil recovery (EOR). To clean up the entire value chain from well-head to consumption would mean that all drilling and fracking equipment be run electrically with renewable energy as the source (very unlikely); using renewable energy for things like pump jacks, water pumps and compression equipment; eliminating or substantially reducing all methane emissions; capturing all the emissions from natural gas processing plants, fractionation plants, industrial plants and power plants and sequestering those emission in underground reservoirs; and converting their considerable consumption of electrical energy to renewable power generation.

All these changes present substantial challenges. The methanol and ammonia supply chain would need to be secured from start to finish. In this world, the E&P, midstream and downstream companies that have solved these challenges will increasingly be selected to provide the gas, the NGLs, the LNG and the oil to help run the world. Those entities that can’t or won’t pledge may need to be sold to those that will. It is a race to net-zero and the winners get all the marbles.

With carbon capture, there is also the potential to produce methanol from petroleum coke, a very dirty and inexpensive solid byproduct of the crude oil refining process that is normally shipped overseas (primarily to China and India) due to the harmful emissions from burning it. One of the largest projects of its kind, Lake Charles Methanol is slated to begin production on such a facility in Louisiana in 2023-2025 using CCS to store 4 million tons of CO2 emissions per year with petcoke as a feedstock. To put this volume of CO2 emissions into perspective, EnLink Midstream – a company that transports roughly 6% of the US natural gas supply and owns 22 natural gas processing facilities and 7 fractionators – has a similar carbon footprint across their entire multi-state operations.

CCS is a double-edged sword because it may generate interest in restoring coal fired power plants and processing dirtier fuel sources like petcoke using CCS as a pathway to decarbonize, but the consensus supports its use because any progress begets more infrastructure which is sorely needed to kickstart the tremendous investment required globally. Although other pathways (for example natural gas) are potentially cleaner, CCS in whatever form it takes is a bridge to lower emissions. The same argument applies to EOR which is a process of using CO2 to produce oil in tertiary recovery. Although the process produces more oil, the infrastructure needed for that progress could kickstart progress towards CCS. Nearly all of the CO2 sourced for EOR is naturally sourced providing no benefits to reducing our world’s carbon emissions, but the infrastructure could be leveraged to capture anthropomorphically sourced CO2. This is a primary goal of Denbury (DEN) a US based oil and gas producers who uses CO2 for in their EOR processes.

Conclusions

There are several key conclusions we can draw from this example. First and foremost is the increasing role that governing bodies are playing in the energy transition. From the changing laws and policies in California to the carbon taxes required in Europe and Canada, policy makers are increasing requiring ever stringent rules to help propel the net-zero 2050 movement. For example, in January 2020, the International Maritime Organization instituted stricter regulations requiring a 3% reduction of the sulfur content in shipping fuel (reducing it from 3.5% to 0.5%).

In fact, the process to regulate CO2 and other greenhouse gases has already begun, therefore it is prudent for major shipping companies to begin converting their ships to cleaner burning fuels to address policy changes that are likely to be instituted in the coming decades. Not fully discussed and perhaps a topic for a future article is the impact of these changes on inflation. Energy is the lifeblood of the economy and raising energy costs ultimately lands in the lap of the consumer. Although we showed in the previous article that there are efficiencies to be gained through for example, the switch to electric vehicles, the net-zero process has the potential to be inflationary and consumers may rebel and balk at those changes which could in turn produce a drag on the pace of change.

If we follow both the conversion of gasoline powered cars to electric vehicles and ships to cleaner propulsion, it slowly (over many decades) shifts the source energy to cleaner pathways. That means less oil and potentially more natural gas and as much wind and solar as the world can build, but ultimately, economics still rule the roost. While producing e-fuels with renewables energy seems like the logical pathway from an emissions standpoint, it is substantially more expensive, and renewables simply can’t support the entire energy pie. As shown, shifting to cleaner burning fuels like blue methanol and ammonia outsources the emissions to our industrial sector where capturing emission is theoretically feasible. The use of natural gas and potentially coal (or byproducts) with CCS seems like a reasonable compromise between economics and sustainability, but in all cases, infrastructure is in its infancy and the transition is complex. (The topic of CCS and EOR is so vast, that we will save the bulk of that discussion for a future article.)

With the divestment of oil and gas will come less supply. If that divestment outstrips demand, prices for oil and gas will rise substantially. For example, in the US, we saw how less drilling in 2020 produced less oil and less associated natural gas. That drove WTI prices above $70 per barrel in 2021, and less associated gas helped drive Henry Hub prices to their current price of roughly $4/mmbtu. We haven’t seen sustained summertime prices for gas at $4 since 2014. Net-zero potentially requires more natural gas because several of the pathways to produce clean burning fuels like ammonia and methanol derive from natural gas. Although many balk at the use of use of natural gas because of methane leaks, it acts as a bridge fuel.

The final point and perhaps less obvious is that higher commodity prices and lower growth CAPEX in energy companies is driving hefty flows of free cash flow which can be reinvested into alternative investments like the joint venture between Saudi Arabi and Air Products and Chemicals. Heavy investors of energy can also follow that pathway. They can use their outsized energy dividends and returns to reinvest in other companies (outside of energy) as a hedge and invest in conservatively run energy companies that are addressing climate change and leading the ESG charge. In short, both energy companies and energy investors have options, and the move to net-zero doesn’t have to be a death sentence for those that embrace the change and have the surplus cash flow to reinvest.

This article was written byAaron GoldbergFollow231 FollowersI have over 30 years of personal investing experience. I do not consider myself an expert but I enjoy under… more

Value, Growth, Long-Term Horizon

Contributor Since 2021I have over 30 years of personal investing experience. I do not consider myself an expert but I enjoy understanding and learning about financial markets, particularly energy markets.

Disclosure: I/we have a beneficial long position in the shares of ENLC, TRGP, EPD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.