“What if 2025 is the polar opposite?”

Welcome back to our first feature article for 2025. Following a more than decade long tradition, we start the year with 5 surprises to watch out for on your radar screens.

Usual caveat: these are not forecasts or predictions but cover areas where we think it is worth:

- challenging prevailing market consensus

- considering the potential value & risk impact of a non-consensus outcome.

Now with the small print out of the way, let’s get into it.

1. Major energy market price swings

Power & gas price volatility last year was relatively subdued. What if 2025 is the polar opposite?

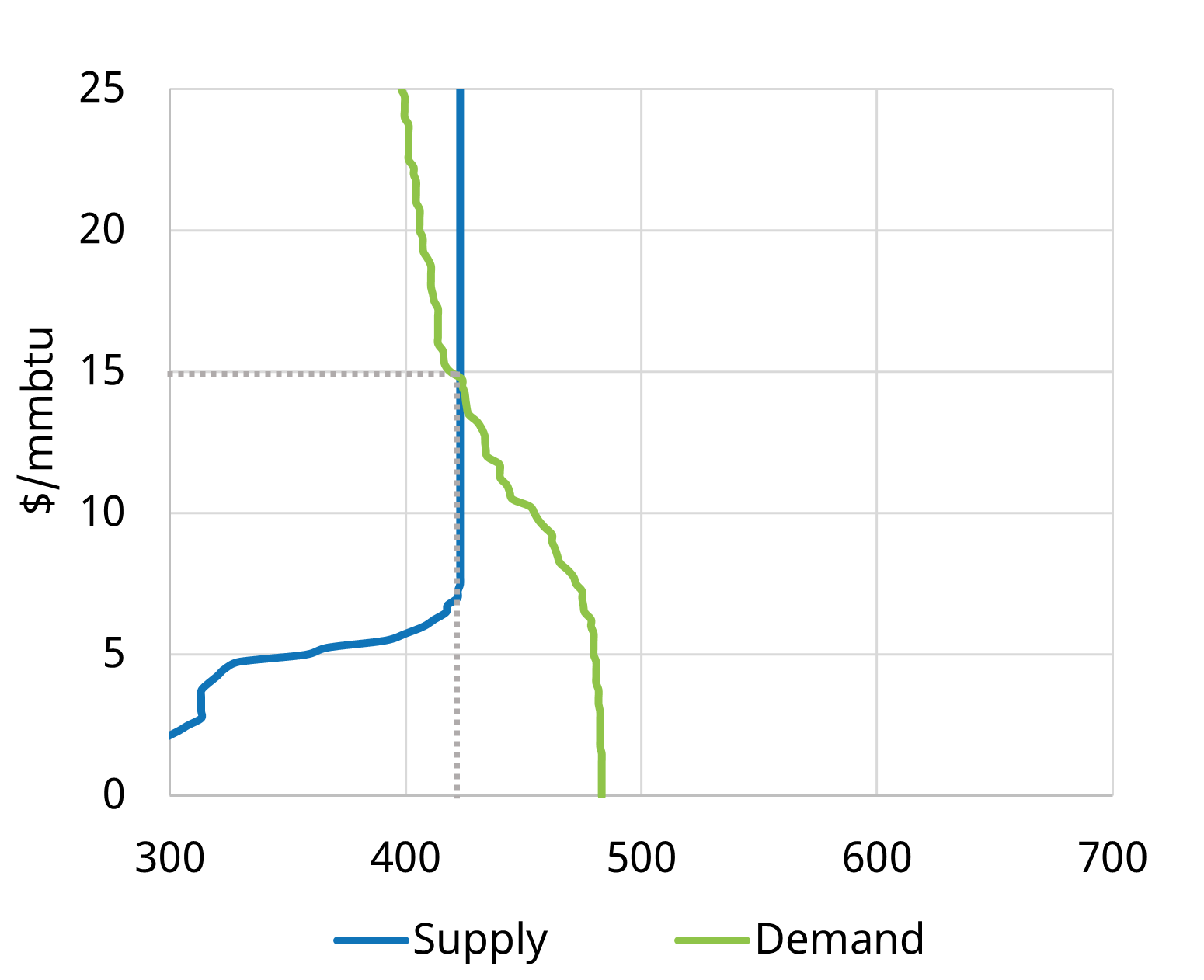

Chart 1 illustrates the relatively inelastic response of combined LNG & European gas market supply & demand in 2025 from our Global Gas Model. Under these conditions, small changes in market balance may drive big swings in gas prices. These swings are directly transmitted to power prices via gas-fired plants setting marginal prices.

Chart 1: LNG & European gas market supply & demand balance 2025

Source: Timera Global Gas Model

What if within 2025:

- TTF front month prices for fluctuate across a more than 40 EUR/MWh annual price range e.g. (double the price range of 2024)?

- JKM front month prices fluctuate across a more than 12 $/mmbtu range?

- front month US Henry Hub gas prices more than double, instead of going down as predicted by the new US administration?

If you want more details on the dynamics behind the risk of price swings, feel free to contact us for a sample copy of our latest Global Gas Report (david.duncan@timera-energy.com).

2. Big policy focus shift to competitiveness in Europe

Mario Draghi fired a broadside at European politicians in Sep 2024 when he published a cornerstone report on “The Future of European Competitiveness”. He threw down a direct challenge to the EU: high energy costs are undermining European competitiveness.

EU industries face electricity prices 2-3 times higher than those in the U.S. and China, and gas prices up to five times higher, significantly impacting European competitiveness & economic growth.

There is a risk this reality bites hard in 2025 with policy shifting to focus on economic competitiveness, for example resulting in:

- Protectionist intervention via subsidies & tariffs to try & support European industry

- Major splits in European policy cooperation i.e. countries strongly pursuing national interests

- At least one European government falling due to energy policy

- Renewed focus on gas market & assets as the key driver of marginal unit of energy

- Dilution of EU gas storage mandates (to reduce price impact of injection requirements).

The impact of these policy swings is unlikely to be smooth.

3. Grid flexibility becomes the new bottleneck

Price spike episodes from Dunkeflaute type market events due to low RES output, have captured both policy & industry attention. These are helping to drive recognition of a growing flexible capacity investment deficit across European power markets.

Watch for a major shift in policy actions to reflect this e.g.

- Redesign of curtailment & balancing costs rules that increase burden on RES assets

- Policy changes to push more merchant exposure onto RES assets

- Connection access rules becoming stricter e.g. introduction of ‘use it or lose it’ rules

- New policy mechanisms developed to support flex asset investment e.g. capacity payment & ancillary revenue support for BESS, LDES & gas peakers.

Could 2025 be the year that grid flexibility is elevated to the status of ‘No 1 threat’ to security of supply?

4. Surge in European battery investment FIDs

There is now about 30GW of installed battery storage capacity across European power markets. So far BESS deployment has been dominated by 3 key markets: GB, Germany & Italy (which account for more than 80% of installed capacity).

What if BESS Final Investment Decisions (FIDs) surge across Europe in 2025 to a level comparable with total capacity installed across the last 10 years (i.e. 30GW)?

What could drive such strong BESS investment momentum:

- Robust revenue stacks (see Chart 2 below)

- Value pick up from transition to 15 min granularity markets (e.g. German Day-Ahead)

- Maturing BESS offtake markets (e.g. toll / floor / index structures) & access to debt finance

- Implementation of a new Spanish Capacity Market & MACSE storage auctions in Italy

- Improving grid connection access e.g. jumping queues via providing TSO/DSO congestion management services

- Accelerating cell cost decline e.g. if Trump tariffs see Chinese cells discounted into Europe.

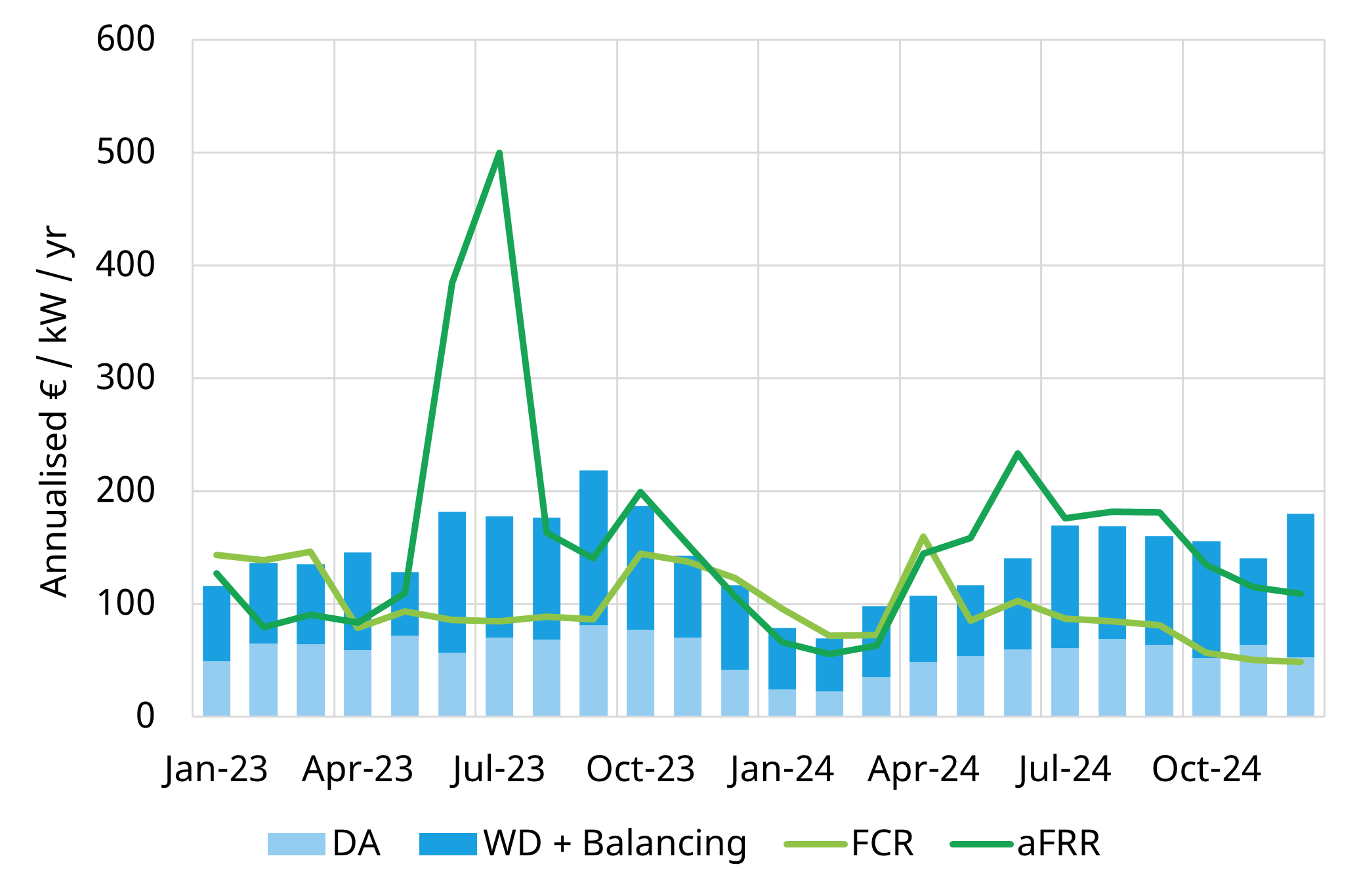

In Chart 2 we show backtested German battery revenues from our BESS dispatch optimisation model. These show both strengthening energy arbitrage revenues through 2024 (helped e.g. by Dunkelflaute events) as well as strong ancillary price signals.

Chart 2: Back-tested German BESS revenues (2 hr duration)

Source: Timera BESS dispatch optimisation model

If you are interested in sample copies of our latest BESS investment reports on GB, German or Italian markets feel free to reach out (steven.coppack@timera-energy.com).

5. Major macro policy shifts cause market volatility

The world is a long way from a stable policy equilibrium entering 2025. The incoming US administration plans to aggressively cut taxes, government & immigration at the same time as waging a trade war.

China, the world’s second largest economy & largest commodity consumer, is in the midst of a deflationary bust which it is trying to fight with major stimulus packages.

Could 2025 be a year when macro drivers hit energy markets? For example resulting in:

- US policy transition causing disorderly market volatility

- A surge in protectionism, driven by Trump tariffs & trading partner response

- A Chinese deflationary spiral, triggering commodity price volatility

- A global economic downturn…

- … triggering major new monetary & fiscal stimulus programs

This could contribute to our surprise No 2. above on major energy price swings.

We wish you all the best in navigating these (& many more) surprises in 2025! And feel free to reach out to us if you would like to catch up.

You can also catch us in person at the Energy Storage Summit in London (18-19th Feb), and E-world in Essen (11-12th Feb).