The US Gulf of Mexico (GOM) has long been a sound investment opportunity for operators looking for world-class oil fields, stable government regimes, and predictable regulatory requirements. Since the 1980s, the region’s deeper waters have been populated by fresh infrastructure as commercial discoveries were made, appraised, and developed. Today, more than two dozen floating production platforms and miles of export and transport pipelines populate the area, with more on the way as producers continue successful exploration programs in the area. There have been nearly 90,000 offshore wells drilled in the GOM to date.

The GOM arena has experienced a few bumps in the road over the past few years due to both COVID-19 and the challenges to the most recent lease sale that was revoked, then later reinstated. While GOM oil production dipped from its peak in 2019 due in part to the global pandemic, the area is still an appealing region for operators. Operators used that period to focus on short-cycle and low‑cost recompletions, infills, and tiebacks rather than larger, capital-intensive projects.

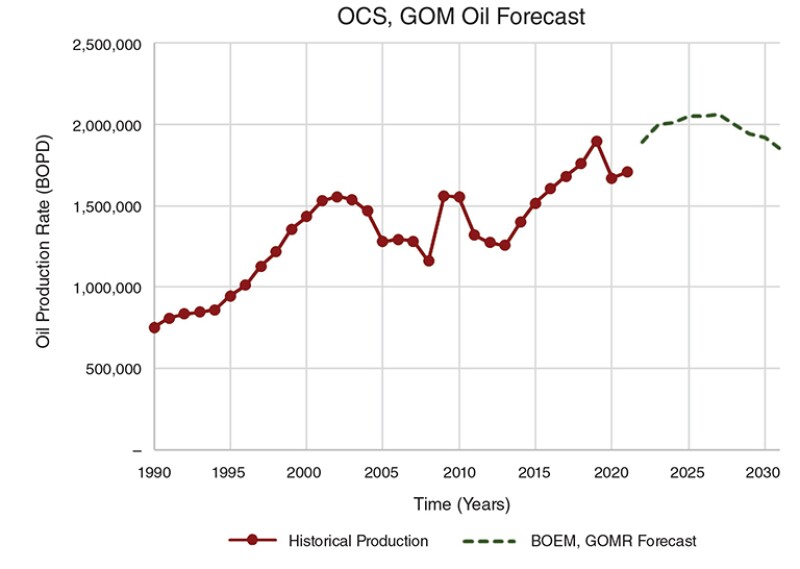

According to a report released by the US Bureau of Energy Management (BOEM), GOM production is expected to experience growth and multiple record years of total oil production, despite off-trend production levels in 2020 and 2021. Gas production is expected to experience moderate increases but is not expected to rebound near previous highs. The growth in annual oil production predicted in the following years is supported by a strong project queue as deferred projects will now be executed. From 2022 through 2024, oil production is forecast to have strong growth, followed by a relative plateau (until 2027) and a gradual decline through 2031, the end of the forecast period (Fig. 1). Around 70% of new GOM production in 2023 is expected to come from just three projects: BP’s Argos, Shell’s Vito, and Murphy’s King’s Quay.

The predicted decline may be due in part to the number of new wells being drilled in the area. The well count for the GOM in general had a decade’s peak back in 2018; however, the count has trended down ever since. According to analysts at Enverus, industry averaged almost 30 ultradeepwater wells per quarter during 2018 and 2019. Last year, that number was around 15. With fewer wells come fewer discovery opportunities. With fewer discoveries backfilling the queue of potential developments, the GOM could be headed for a lull in new project commitments. Additionally, Wood Mackenzie research found that net discovered resource by company in the GOM fell from more than 1 billion bbl in 2017 to around 250 million bbl in 2021.

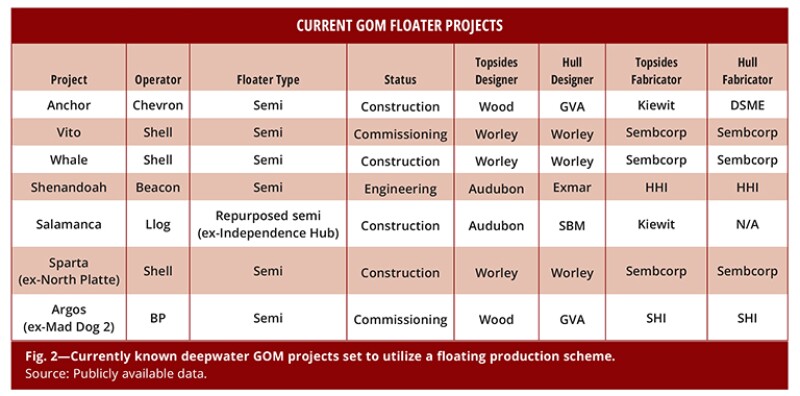

Research from Rystad Energy showed just two deepwater GOM hub-based developments received a green light in 2021 (Shenandoah and Whale), while so far in 2022, only one (Salamanca) has been approved (Fig. 2). Counter to that, several subsea tiebacks are in the queue. While these historically represent smaller production volumes, they also represent significantly reduced cycle times from inception to first oil.

“Going through the crash of 2020 and then coming out of that, there’s not been a huge rush of capital back to the markets to invest in hub-scale exploration,” explained Colin White, upstream research analyst for Rystad Energy. “The response and guidance that we’ve seen from operators is a focus on existing infrastructure and maximizing currently held near-field exploration acreage. Rystad did an analysis recently and found a majority of extant facilities in the GOM are underutilized capacity-wise. So, operators could go in and easily fill those hubs with short-lead-time projects—2- to 3-year tieback developments from discovery to first oil. That really limits their exposure to what’s been a pretty volatile market over the past few years.”

Subsea projects forwarded in 2022 include Chevron’s Ballymore and Beacon’s Winterfell. Future projects in the queue for 2023/2024 final investment decisions (FID) include Equinor’s Monument, BP’s Puma West, LLOG’s Buckskin South, and Shell’s Dover and Fort Sumter, among others.

These projects will be feeding the predicted short-term growth in GOM oil production.

Shell Leads the Pack

Shell has a healthy mix of in-progress field developments in the GOM: Vito and Whale are twin developments using basically the same small semisubmersible production system design, while Rydberg (sanctioned in 2022), Fort Sumter, and Dover (pre-FID) are projects expected to proceed to development as subsea tiebacks to the nearby Appomattox floater in the Norphlet trend, which has performed a bit below expectations. Further down the road is a decision on North Platte, now Sparta, which the company joined after TotalEnergies’ about-face on the project.

The Vito platform is on location in Mississippi Canyon Block 939 and is undergoing final hookup and commissioning ahead of its early 2023 startup. The field is estimated to hold around 300 million BOE and is expected to produce around 100,000 BOE/D at peak. Shell operates Vito with a 63.11% interest; partner Equinor holds the remaining 36.89% stake.

The semisubmersible for Whale is under construction at Sembcorp in Singapore. The Worley-designed facility is a near carbon copy of its predecessor Vito, with main differences being natural gas handling. The facility will be installed in Alaminos Canyon Block 773 and at peak is expected to produce around 100,000 BOE/D. First oil from Whale is slated for 2024. Shell operates Whale with a 60% working interest; Chevron holds the remaining 40% stake.

“Deepwater has become more of a commodity, and we need to make the possible affordable,” said Kurt Shallenberger, Vito project manager for Shell. “I compare it to the space shuttle and SpaceX. We go from cool, big, new stuff, but we really need something that’s simple and that can be repeatable. Luckily, Whale gave us the opportunity to be repeatable. Vito’s focus was to be simple.”

Rydberg was sanctioned earlier this year as a two-well subsea tieback to the Appomattox platform. The field is estimated to hold around 100 million BOE. Shell expects peak production from the field to be around 16,000 BOE and begin in the second half of 2023. One-time partner Ecopetrol opted out of the project, surrendering its 28.5% stake in the field. Shell operates Rydberg with an 80% working interest; partner CNOOC holds the remaining 20% stake.

Fort Sumter, around 12 miles southwest of Appomattox, was discovered in 2016 in Mississippi Canyon Block 566. Following appraisal, it was determined that the field holds roughly 125 million BOE. Dover, about 13 miles from Appomattox in Mississippi Canyon Block 612, was discovered in 2018 with the initial well encountering more than 800 ft of net pay. Both Fort Sumter and Dover are expected to join Rydberg as future subsea tiebacks to Appomattox.

Sparta is the former North Platte discovery—a 20k-psi find in Garden Banks Blocks 915, 916, 958, and 959. After TotalEnergies walked away from the project, leaving partner Equinor with a 100% stake, the Norwegian company sold a 51% controlling interest to Shell. Front-end engineering and design was done by Worley, who is also designing the semisubmersible. Sembcorp is in line for construction. The field was discovered by now-defunct Cobalt Energy in 2012.

BP Unlocking More From Existing Fields

Much of the major investments BP is making in the GOM currently centers on expansions of existing developments. It recently conducted a $1.3-billion Phase 3 at its Atlantis field with a goal to unlock some of the additional 400 million bbl of oil in place from the field revealed by seismic imaging and reservoir characterization. The operator was also working to unlock another possible billion BOE from its Thunder Horse field.

BP’s Mad Dog expansion comes in the form of the Argos production platform undergoing final commissioning on location in Green Canyon Block 780 ahead of first oil expected this year. The $9-billion Argos/Mad Dog Phase 2 project is expected to produce up to 140,000 BOE/D via subsea wells tied into the facility.

Puma West will also likely be additive to the Mad Dog resource. The Green Canyon Block 821 discovery made in the spring of 2021 encountered Miocene-aged pay located just to the west of Mad Dog. Puma West may end up as a future satellite development to the field. BP operates Puma West with a 50% working interest; partners Chevron and Talos Energy each hold 25% stakes. The partners are planning an appraisal well prior to year-end with results expected in early 2023.

In 2021, BP said its net production from the GOM was around 290,000 BOE/D, expecting it to grow to around 400,000 BOE/D by the mid-2020s.

Chevron Exploits Hub-and-Spoke Concept

On the hub front, the anchor of Chevron’s current deepwater GOM development slate … is Anchor. The Green Canyon Block 807 field is being developed via seven subsea wells tied back to a newbuild semisubmersible FPU, capable of producing 75,000 BOPD and 28 MMcf/D of natural gas. The Anchor facility will be the first 20,000‑psi system in the GOM. The hull for the FPU was recently completed at Daewoo Shipbuilding & Marine Engineering in Singapore. The topsides facility remains under construction at Kiewit Offshore in Ingleside, Texas.

The $5.7-billion project will tap Wilcox-aged reservoirs estimated to hold as much as 440 million BOE. First oil from Anchor is expected in 2024.

The supermajor recently sanctioned its $1.6-billion Ballymore project in the Mississippi Canyon area. This major spoke will be developed via a trio of subsea wells tied back to the Blind Faith FPU in Block 696. Ballymore will be Chevron’s first development in the Norphlet trend. The recoverable oil-equivalent resources for Ballymore is estimated at more than 150 million bbl. Chevron expects the field to start producing in 2025.

“Ballymore is an interesting one because it was a nice-sized discovery, but we could really capitalize and get a much higher return by taking three wells back to a host facility at Blind Faith and be able to develop that,” Jay Johnson, Chevron executive vice president of upstream, told investors this summer. “We’re pleased to be able to see that higher return coming from Blind Faith, and it also helps our existing production at Blind Faith.”

Counting successful startups at Mad Dog Phase 2 (15.6% working interest), the St. Malo injection project, Anchor, Whale, and Ballymore, Chevron expects its daily GOM production to increase to over 300,000 BOE/D by 2026—a 50% jump in produced volumes in the region.

Beacon Leads the Indie Charge

Another 20k-psi project in the offing is the development of the Beacon Offshore-lead Shenandoah field in Walker Ridge Blocks 51, 52, and 53. The field will be developed using a newbuild semisubmersible FPU designed by Exmar (hull) and Audubon Engineering (topsides). The platform is under construction at Hyundai Heavy Industries in Korea. The semisubmersible for the $1.8-billion project will be 91×90×91 m with a production capacity of 100,000 BOPD and 140 MMcf/D of natural gas. Hyundai began the construction of the facility in the third quarter of 2022. Once completed, this system will be transferred to the US and is expected to be installed at the Shenandoah field site in the third quarter of 2024.

Another Beacon project moving forward is its Winterfell find in the Green Canyon area. Winterfell is believed to hold up to 200 million BOE, with half of those reserves targeted for recovery in the initial phase of development. Phase one consists of five wells, with three wells online at first oil, tied back to a nearby FPU. FID is imminent.

The Winterfell discovery well, in Block 944, tested a sub-salt Upper Miocene prospect and encountered about 26 m of net oil pay in two intervals. A follow-up in adjacent Block 943 discovered about 40 m of net oil pay in the first and second horizons with better oil saturation and porosity than pre-drill expectations.

First oil at Winterfell is expected about 18 months after FID.

LLOG Cuts Into Lead Time With Reuse Model

LLOG’s current crown jewel is Salamanca—also known as the second coming of Independence Hub. The company purchased the decommissioned semisubmersible production unit with plans to re-use the hull with a new topsides package to develop its Leon and Castile discoveries in the GOM’s Keathley Canyon area. The facility is undergoing its transformation at Kiewit Offshore Services in Ingleside, Texas. Once complete, the facility will be moored in Block 689 and be capable of producing around 60,000 BOPD and 40 MMcf/D of natural gas.

LLOG has also been exploiting various near-field satellite opportunities to existing infrastructure. The company’s Spurance field in Ewing Bank Blocks 877 and 921 came on line this summer producing 16,000 BOPD and 13 MMcf/D of gas via a two-well, 14-mile subsea tieback to the EnVen-operated Lobster platform in Ewing Bank Block 873. First production was achieved less than 3 years after the initial exploratory discovery well was drilled.

The operator’s Taggart discovery, located on Mississippi Canyon Block 816, is expected on line prior to year-end. The Block 816 discovery well was drilled in 2013 and encountered a total of 97 ft of net pay in two Miocene objectives. Two subsequent appraisal wells were drilled in 2015 and 2019 and encountered 147 ft and 84 ft of net pay, respectively. Earlier this year, LLOG completed a deal to tie the discovery into Eni-operated subsea infrastructure that leads back to the Williams-operated Devil’s Tower spar in Mississippi Canyon Block 773.

Dome Patrol, located in Mississippi Canyon Block 505, is a small oil and associated gas discovery made by LLOG in July 2020. It lies about 6 miles to the northeast of the operator’s Who Dat facility in Mississippi Canyon Block 547. LLOG ordered the subsea equipment to produce Dome Patrol in early 2021. The field is expected on line imminently.

Times, They Are A-Changin’

The GOM is hardly the ‘Dead Sea’ as it has been proclaimed many times in the past, but there has been a definite shift in operator’s appetites for certain projects—whether that’s TotalEnergies walking away from developments or a stalwart like Shell completely reimagining what a hub facility should look like and be capable of to get the best results out of each discovery. The lack of discoveries in the region is not the best sign for future production, but a few bright spots emerged recently including Hess’ successful return to deepwater GOM exploration after a 2-year hiatus and its find at Huron in Green Canyon Block 69.

“With the passage of the IRA (Inflation Reduction Act), high bid awards are now reinstated from Lease Sale 257, we’ll see if that drives growth in exploration activity,” said White. “There were some interesting results from that (sale), in regard to BP acquiring a set of blocks in the DeSoto Canyon and Lloyd Ridge protraction areas, which are considered regions of frontier exploration. Occidental also acquired some frontier acreage in the Alaminos Canyon area for extremely high bid amounts. We’ll see what comes of it. I think the focus is still primarily going to be on ILX (infrastructure-led exploration). I don’t see hub‑scale exploration taking off, even with prices the way they are. The sentiment from the companies we’ve interacted with is they are going to be ILX players, and that’s how the Gulf of Mexico is likely going to move forward.”

He added, “I think what you may see though is more acreage leased for purposes other than hydrocarbon exploration as witnessed in Sale 257 where ExxonMobil acquired 94 blocks across the shelf, presumably for future CCS developments. We may see more activity on that front as far as additional large capital investments, but from a hydrocarbon exploration standpoint, there hasn’t been too much real frontier exploration activity over the last year.”